Clean Harbors Reports First-Quarter 2009 Financial Results

Company Revises Full-Year Revenue and EBITDA Guidance Exclusive of Acquisitions

Norwell, MA – May 6, 2009 – Clean Harbors, Inc. (“Clean Harbors”) (NYSE: CLH), the leading provider of environmental and hazardous waste management services throughout North America, today announced financial results for the first quarter ended March 31, 2009.

For the first quarter of 2009, Clean Harbors reported revenue of $206.3 million compared with $242.5 million in the first quarter of 2008. Income from operations was $10.7 million compared with $20.0 million in the first quarter of 2008. First quarter 2009 net income was $5.0 million, or $0.21 per diluted share, compared with $8.9 million, or $0.43 per diluted share, in the first quarter of 2008. Weighted average diluted shares outstanding used to calculate the net income per share in the first quarter of 2009 were 23.9 million, versus 20.9 million in the first quarter of fiscal 2008.

EBITDA (see description below) was $25.4 million compared with $33.1 million in the first quarter of 2008.

Comments on the First Quarter

“While we were anticipating a slow start to 2009, the challenging economic climate throughout North America resulted in a substantial slowdown in certain industries we service, such as chemicals and manufacturing, where some customers temporarily closed plants in an attempt to lower costs,” said Alan S. McKim, Chairman and Chief Executive Officer. “Our revenues also were negatively affected on a year-over-year basis by the continued weakness of the Canadian dollar and a reduction in fuel surcharges. Additionally, persistent unfavorable weather conditions during the quarter severely hindered our revenue opportunities in both our Technical and Site Services segments.”

“Despite the overall revenue softness, activity levels across many of our business lines remained high and we built a sizeable backlog of projects,” McKim said. “By quarter end, particularly as the weather improved, many customer locations, including those which had experienced temporary outages, were up and running. As we entered the second quarter, the flow of volumes into our plants has increased and some of the projects that had been delayed are moving forward.”

“During the quarter, we continued to position ourselves for the rebound we expect in the second half of the year. We further streamlined our entire organization and our lean cost structure should enable us to capture the leverage that is inherent in our extensive network of assets. We completed the expansion of our sales force as we began to ramp up an aggressive marketing strategy within the industrial sectors we serve. Our ongoing capacity expansion plans are proceeding on schedule as we intend to bring an additional 10,000 tons of capacity online by mid-year. Lastly, we continued to carefully evaluate a number of prospective acquisition candidates, which resulted in our acquisition of EnviroSORT in late February and culminated in our April 29th announcement of the signing of a definitive agreement to acquire Canadian-based Eveready Inc. in a transaction valued at approximately $387 million.”

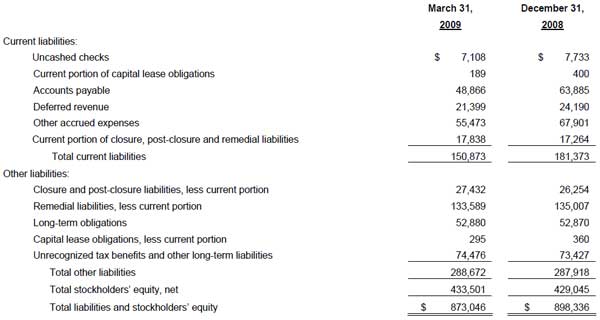

Non-GAAP First-Quarter Results

Clean Harbors reports EBITDA results, which are non-GAAP financial measures, as a complement to results provided in accordance with accounting principles generally accepted in the United States (GAAP) and believes that such information provides additional useful information to investors since the Company’s loan covenants are based upon levels of EBITDA achieved. The Company defines EBITDA in accordance with its existing credit agreement, as described in the following reconciliation showing the differences between reported net income and EBITDA for the first quarter of 2009 and 2008 (in thousands):

Business Outlook and Financial Guidance

Based on its first-quarter performance and current market conditions, Clean Harbors is revising its guidance for 2009. The Company currently expects full-year 2009 revenue, exclusive of acquisitions, to be flat to slightly down compared with 2008, and EBITDA in the range of $163 million to $167 million, compared with $163.2 million in 2008. Previously, the Company expected 2009 revenue growth in the range of 3 to 4 percent and year-over-year EBITDA growth in the range of 10 to 15 percent.

“While we remain encouraged about our prospects for the full year, our performance in the first quarter, combined with the ongoing economic uncertainty, have led us to adjust our 2009 guidance,” McKim said. “We continue to expect our revenues and EBITDA growth to be skewed toward the second half of this year. Our recently expanded sales force and comprehensive vertical market strategy will yield results as the year progresses. We remain confident that our well-known brand, outstanding reputation, and vertical market expertise will afford us the opportunity to gain market share during this time of economic turmoil.”

“We also expect that the federal economic stimulus package will benefit Clean Harbors in the quarters ahead,” said McKim. “Hundreds of millions of dollars in federal funds have been allocated toward areas in which we specialize, including Superfund site cleanups, environmental work at DOE sites, removal of underground storage tanks and remediating Brownfield locations. The federal government recently published a list of Superfund sites that are being targeted for increased cleanup and those locations include many where Clean Harbors is already an active participant in remediation or revitalization efforts. We are beginning to enter the proposal stage for some of the additional projects at these sites and anticipate significantly increased activity from the federal stimulus later this year.”

“We believe our recently announced agreement to acquire Eveready will generate momentum within our existing Clean Harbors businesses,” McKim said. “The transaction will enhance our presence in industrial services, which has been a growth business for us in recent years. It will broaden our geographic footprint and provide us with valuable new resources in some of our end-markets. Most importantly, we believe it will afford us numerous cross-selling opportunities within our existing customer base as well as with Eveready’s blue-chip customer base, particularly in the refineries and other energy business sectors. We look forward to completing the acquisition during the third quarter and harvesting the benefits of the combined company in the years ahead.”

Conference Call Information

Clean Harbors will conduct a conference call for investors to discuss the information contained in this press release today, Wednesday, May 6, 2009 at 9:00 a.m. (ET). On the call, Chairman, President and Chief Executive Officer Alan S. McKim and Executive Vice President and Chief Financial Officer James M. Rutledge will discuss Clean Harbors’ financial results, business outlook and growth strategy.

Investors who wish to listen to the first-quarter 2009 webcast should log onto www.cleanharbors.com/investor_relations. The live call also can be accessed by dialing 877.407.5790 or 201.689.8328 prior to the start of the call. If you are unable to listen to the live call, the webcast will be archived on the Company’s website.

About Clean Harbors

Clean Harbors is North America's leading provider of environmental and hazardous waste management services. With an unmatched infrastructure of waste management facilities, Clean Harbors serves over 47,000 customers, including more than 325 Fortune 500 companies, thousands of smaller private entities and numerous federal, state and local governmental agencies. Clean Harbors’ Technical Services provides a broad range of hazardous material management and disposal services including hazardous and non-hazardous waste recycling, treatment and disposal, CleanPack® laboratory chemical packing, and household hazardous waste management services. Clean Harbors’ Site Services provides field services, industrial services, vacuum services, emergency response and disaster recovery, transformer services, tank cleaning and decontamination.

Headquartered in Norwell, Massachusetts, Clean Harbors has more than 100 locations strategically positioned throughout North America in 36 U.S. states, six Canadian provinces, Mexico and Puerto Rico. For more information, visit www.cleanharbors.com.

Safe Harbor Statement

Any statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These forward-looking statements are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. The Company undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements other than through its various filings with the Securities and Exchange Commission. Furthermore, all financial information in this press release is based on preliminary data and is subject to the final closing of the Company’s books and records.

A variety of factors beyond the control of the Company may affect the Company’s performance, including, but not limited to:

- The Company’s ability to close its proposed acquisition of Eveready Inc. in a timely fashion, if at all, and successfully integrate Eveready’s operations and assets into the Company’s existing operations and assets;

- The Company’s ability to manage the significant environmental liabilities that it assumed in connection with past acquisitions;

- The availability and costs of liability insurance and financial assurance required by governmental entities relating to the Company’s facilities;

- The effects of general economic conditions in the United States, Canada and other territories and countries where the Company does business;

- The effect of economic forces and competition in specific marketplaces where the Company competes;

- The possible impact of new regulations or laws pertaining to all activities of the Company’s operations;

- The outcome of litigation or threatened litigation or regulatory actions;

- The effect of commodity pricing on overall revenues and profitability;

- Possible fluctuations in quarterly or annual results or adverse impacts on the Company’s results caused by the adoption of new accounting standards or interpretations or regulatory rules and regulations;

- The effect of weather conditions or other aspects of the forces of nature on field or facility operations;

- The effects of industry trends in the environmental services and waste handling marketplace; and

- The effects of conditions in the financial services industry on the availability of capital and financing.

Any of the above factors and numerous others not listed nor foreseen may adversely impact the Company’s financial performance. Additional information on the potential factors that could affect the Company’s actual results of operations is included in its filings with the Securities and Exchange Commission, which may be viewed on www.cleanharbors.com/investor_relations.

Contacts

| Investor Relations Clean Harbors, Inc. 781.792.5100 InvestorRelations@cleanharbors.com |

Jim Buckley Executive Vice President Sharon Merrill Associates, Inc. 617.542.5300 clhb@investorrelations.com |

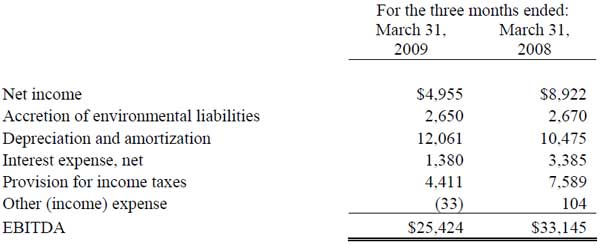

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(in thousands except per share amounts)

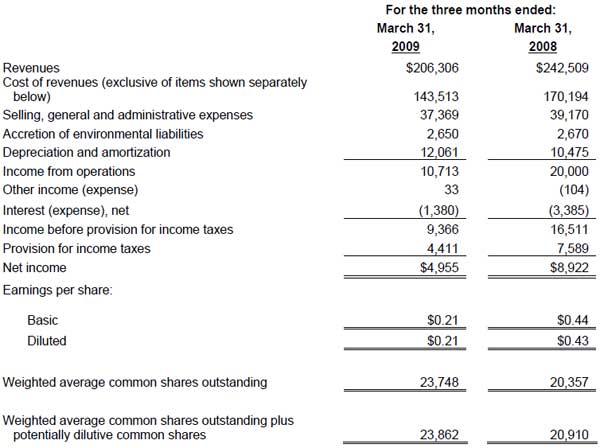

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

ASSETS

(in thousands)

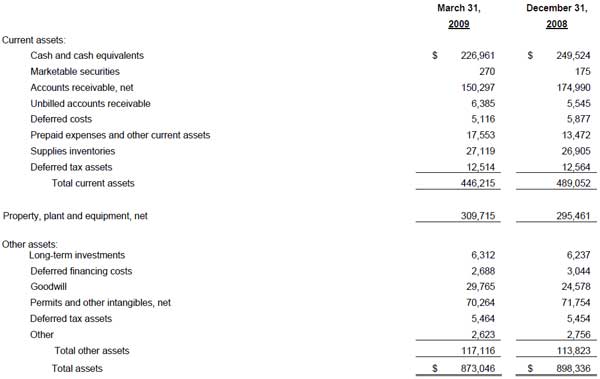

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

LIABILITIES AND STOCKHOLDERS’ EQUITY

(in thousands)