Clean Harbors Reports Second-Quarter 2011 Financial Results

| | Company Delivers Excellent Top- and Bottom-line Results | ||

| | Broad-based Contributions Drive Revenue of $447 Million | ||

| | Strong Margins Boost Net Income to $29.2 Million and EBITDA to $81.2 Million | ||

| | 2011 Guidance Increased on Strength of Performance and Recent Acquisitions |

Norwell, MA – August 3, 2011 – Clean Harbors, Inc. (“Clean Harbors”) (NYSE: CLH), the leading provider of environmental, energy and industrial services throughout North America, today announced financial results for the second quarter ended June 30, 2011.

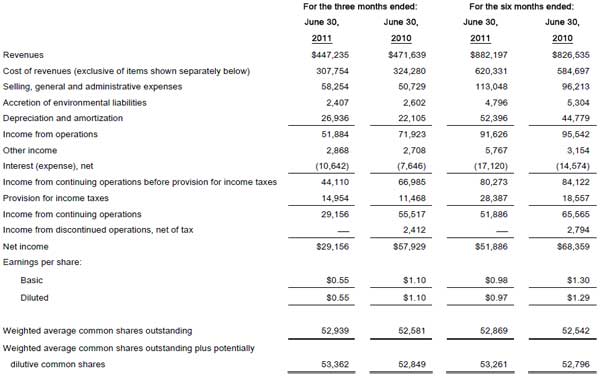

Revenues for the second quarter were $447.2 million compared with $471.6 million in the same period in 2010. The second quarter of 2010 included approximately $109 million of revenue related to the Company’s participation in the Gulf of Mexico oil spill response effort. Income from operations in the second quarter of 2011 was $51.9 million compared with $71.9 million in the same period of 2010.

Clean Harbors recently completed a two-for-one stock split. All share and per share amounts included in this earnings release reflect the stock split and have been adjusted retroactively for all periods presented. Second quarter 2011 net income was $29.2 million, or $0.55 per diluted share on a split-adjusted basis, compared with $57.9 million, or $1.10 per diluted share on a split-adjusted basis, in the second quarter of 2010. EBITDA (see description below) was $81.2 million in the second quarter compared with $96.6 million in the same period of 2010, which included approximately $33 million in EBITDA related to last year’s Gulf event.

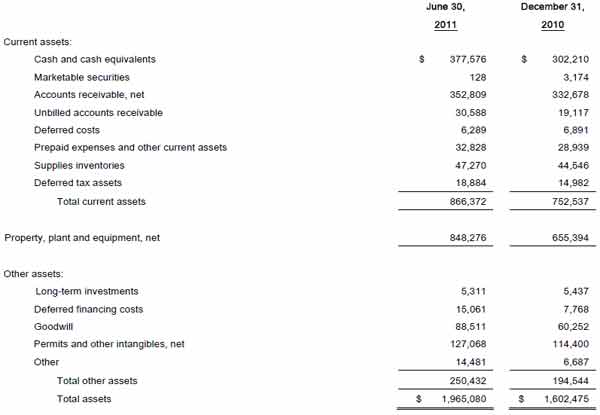

The Company concluded the second quarter with cash and marketable securities of $377.7 million, compared with $305.4 million at December 31, 2010.

Comments on the Second Quarter

“The second quarter of 2011 was another period of solid financial performance and achievement for Clean Harbors,” said Alan S. McKim, Chairman and Chief Executive Officer. “Strong contributions across our four operating segments enabled us to generate revenues of $447 million. Within Technical Services, the utilization rate at our incinerators was more than 92% with contributions from both our U.S. and Canadian facilities. Within Field Services, we saw a steady stream of projects as our core business – exclusive of emergency response events – grew approximately 20% year-over-year. In what is historically the seasonally weakest period for Industrial Services, this segment delivered double-digit growth through substantial turnaround work at our refinery customers. Despite some major wildfires in Western Canada that affected our operations in June, our Oil & Gas Field Services segment grew 40% as continued investments in gas and oil production in both the U.S. and Canada drove demand for our services. This segment also benefitted from the addition of Peak Energy Services, which we acquired on June 10.”

“The addition of Peak greatly expands our presence in oil and natural gas drilling and production support and our Industrial Services business,” McKim said. “Peak complements our service offerings and enhances our one-stop-shop approach for our customers. Peak has brought to Clean Harbors a talented work force, a well-maintained fleet of equipment, an excellent customer base and strategic locations in North America. We believe that Peak will afford us significant cross-selling opportunities going forward.”

“Our second-quarter results once again demonstrated the leverage of our network of assets as we achieved an EBITDA margin of 18.2%,” McKim said. “Excluding the 2010 Gulf oil spill event, our EBITDA growth was 28% – outpacing our revenue growth in the quarter as we continued to successfully implement our pricing initiatives, pass through higher fuel expenses, and tightly manage our cost structure.”

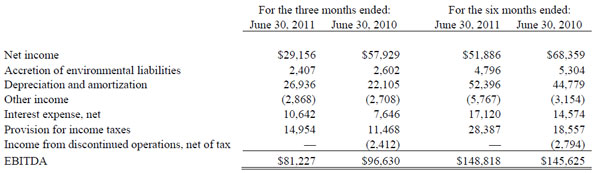

Non-GAAP Results

Clean Harbors reports EBITDA results, which are non-GAAP financial measures, as a complement to results provided in accordance with accounting principles generally accepted in the United States (GAAP) and believes that such information provides additional useful information to investors since the Company’s loan covenants are based upon levels of EBITDA achieved. The Company defines EBITDA in accordance with its existing credit agreement, as described in the following reconciliation showing the differences between reported net income and EBITDA for the second quarter and first six months of 2011 and 2010 (in thousands):

Business Outlook and Financial Guidance

“We concluded the first half of 2011 with momentum and we are optimistic about our prospects going forward,” McKim said. “Within Technical Services, we have a considerable backlog of potential projects in our pipeline to drive substantial volumes through our disposal facilities. Activity in our Field Services segment in the third quarter will be supported by our participation in the Yellowstone River oil spill clean-up effort, which we expect will generate more than $15 million in revenue. We anticipate continued strength in our Industrials Services segment, particularly in some of our specialty lines of business. We expect the addition of Peak to amplify our growth through cross-selling opportunities in our Oil & Gas Field Services segment.”

“We enter the second half of the year with a strong cash position of $378 million that affords us significant financial flexibility. Our strategy is to apply this capital to accelerate our growth through selective acquisitions and strategic investments. At this time, our acquisition pipeline remains active and we are in the process of evaluating a number of potential opportunities,” McKim concluded.

Based on its second-quarter performance, recently completed acquisitions and current market conditions, Clean Harbors is increasing its 2011 annual revenue and EBITDA guidance. The Company now expects 2011 revenues in the range of $1.84 billion to $1.88 billion, up from its previous revenue guidance of $1.62 billion to $1.67 billion. For 2011, the Company now expects EBITDA in the range of $315 million to $320 million, an increase from its previous guidance of $275 million to $284 million.

Conference Call Information

Clean Harbors will conduct a conference call for investors today at 9:00 a.m. (ET) to discuss the information contained in this press release. On the call, Chairman, President and Chief Executive Officer Alan S. McKim and Vice Chairman and Chief Financial Officer James M. Rutledge will discuss Clean Harbors’ financial results, business outlook and growth strategy.

Investors who wish to listen to the webcast should log onto www.cleanharbors.com/investor_relations. The live call also can be accessed by dialing 877.709.8155 or 201.689.8881 prior to the start of the call. If you are unable to listen to the live call, the webcast will be archived on the Company’s website.

About Clean Harbors

Clean Harbors is the leading provider of environmental, energy and industrial services throughout North America. The Company serves more than 50,000 customers, including a majority of the Fortune 500 companies, thousands of smaller private entities and numerous federal, state, provincial and local governmental agencies.

Headquartered in Norwell, Massachusetts, Clean Harbors has more than 175 locations, including over 50 waste management facilities, throughout North America in 37 U.S. states, seven Canadian provinces, Mexico and Puerto Rico. The Company also operates international locations in Bulgaria, China, Singapore, Sweden, Thailand and the United Kingdom. For more information, visit www.cleanharbors.com.

Safe Harbor Statement

Any statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. Such statements may include, but are not limited to, statements about the Company’s business outlook and financial guidance and other statements that are not historical facts. Such statements are based upon the beliefs and expectations of Clean Harbors’ management as of this date only and are subject to certain risks and uncertainties that could cause actual results to differ materially, including, without limitation, those items identified as “risk factors” in the Company’s most recently filed Form 10-K and Form 10-Q. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements other than through its various filings with the Securities and Exchange Commission, which may be viewed at www.cleanharbors.com/investor_relations.

Contacts

| Investor Relations Clean Harbors, Inc. 781.792.5100 InvestorRelations@cleanharbors.com |

Jim Buckley Executive Vice President Sharon Merrill Associates, Inc. 617.542.5300 clhb@investorrelations.com |

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(in thousands except per share amounts)

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

ASSETS

(in thousands)

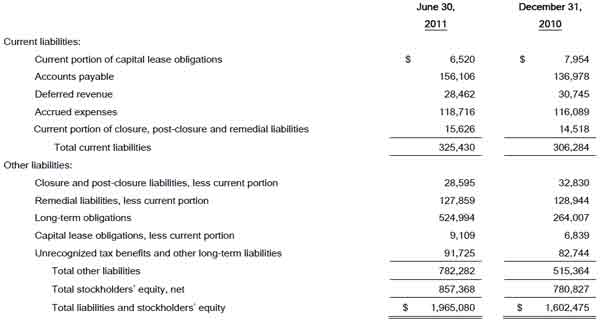

CLEAN HARBORS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

LIABILITIES AND STOCKHOLDERS’ EQUITY

(in thousands)